Metronome

Shall we create some signals?

Sometimes you want to backtest just one Volume indicator alone, without interference from your main Confirmation indicator (C1), for example. For that you need a neutral indicator, and that's exactly what the Metronome is.

The Metronome tool can create Buy/Sell signals and allows you to check if your filter indicator (C2/Volume/News/EVZ) is good at filtering out unwanted signals, without using a random entry indicator.

With this tool you can create alternating signals (between Buy and Sell), random ones or according to the trend (14 SMA). You can also choose the frequency of the signals, fixed or random.

Note that when choosing random modes the results obtained will always be different. In that case, you should analyze the results as a statistical sample.

Download:

So, let's show an example of how you can use this tool:

- We have two similar indicators, the "trend-direction-force-index-indicator" and the "Trend direction and force index - smoothed 4_6", and we intend to analyze which one is better at eliminating bad entry signals.

This type of indicator can be used in many ways but in this case we will use it to confirm the entry signal (C2). Like this:

- If the line is above the upper level (0.05) - Buy Signals are accepted.

- And when the line is below the bottom line (-0.05) - Sell Signals are accepted.

- When the line is between the levels (-0.05 and 0.05) then no type of signal is accepted.

To obtain this type of operation, we must select the TWO LEVEL CROSS option with the levels -0.05 and 0.05:

TWO LEVEL CROSS

;trend-direction-force-index-indicator;3;-0.05,0.05

TWO LEVEL CROSS

;Trend direction and force index - smoothed 4_6;3;-0.05,0.05

(As we are going to test the indicators with the default values the indicator inputs are omitted from the settings)

- Now let's configure the Metronome. The Metronome can be placed in any Indicator Slot in the NNFX Algo Tester but in this case we will use it to produce entry signals, so as C1.

We can choose the type of operation we want, let's select the ARROWS type, to create a alternating signal every 3 candles. That is, a Buy signal will be created and after 3 candles a Sell signal will be generated, and so on.

To get that operation the configuration is as follows:

ARROWS

7,0,0,3,5,15;METRONOME;1,2

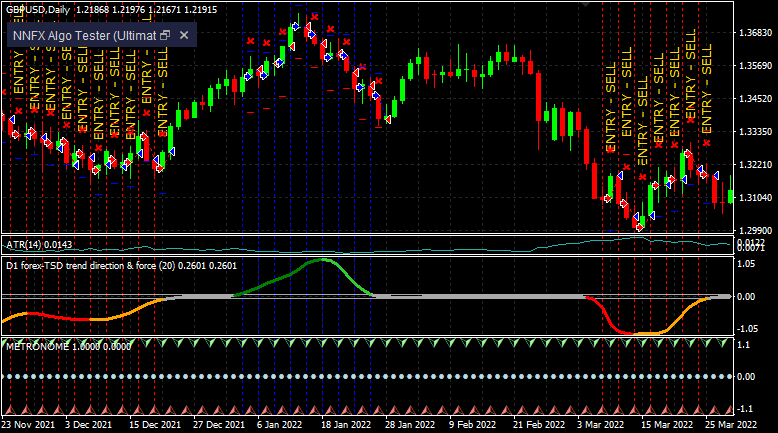

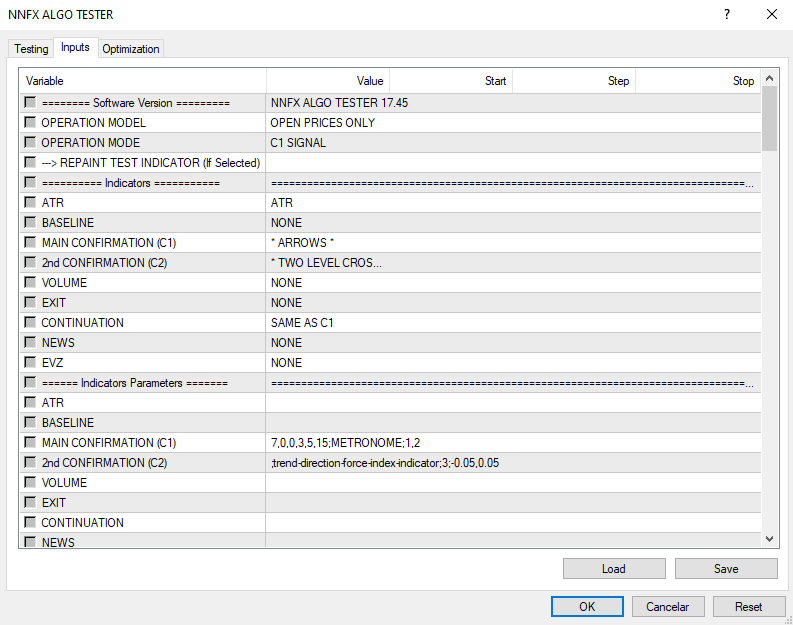

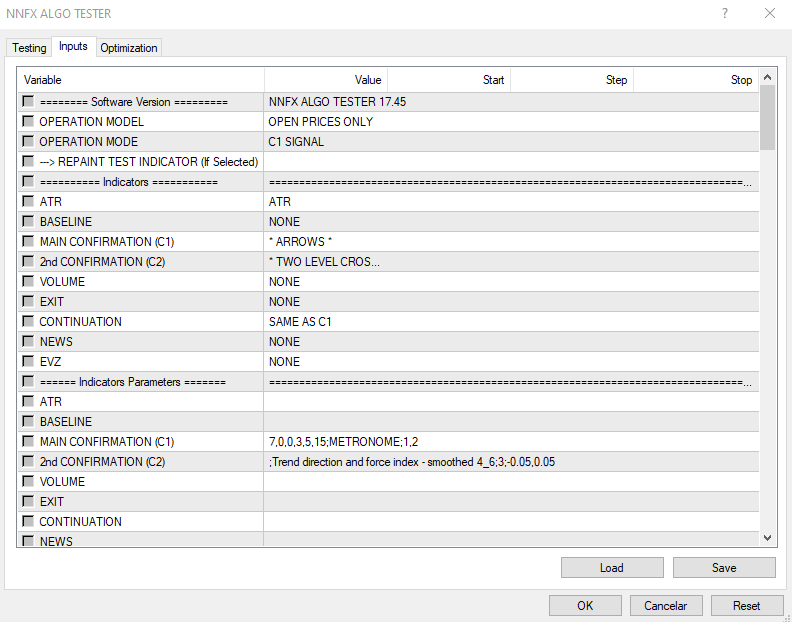

- Now we can start the backtests. We will perform two backtests, with the same Metronome configuration but with different TDFI versions ("trend-direction-force-index-indicator" and the "Trend direction and force index - smoothed 4_6"). The configuration is shown in the images below:

- And we get the results. You can view the signals generated by the Metronome by activating the Visual Mode.

Looking at the results we can say that the "trend-direction-force-index-indicator" version produced better results and was able to filter out more bad signals. With a higher Win Rate and profit Factor and a lower Drawdown.

Of course, to obtain a more reliable result, you should extend the backtest in several instruments.

As you can see Metronome can be a nice addition to the tools you already have available. You can use it to compare versions of indicators, as shown above, but also completely different indicators, this without the interference of another external indicator where control is often limited.

Metronome is a neutral indicator where you can choose exactly how the signals are generated.

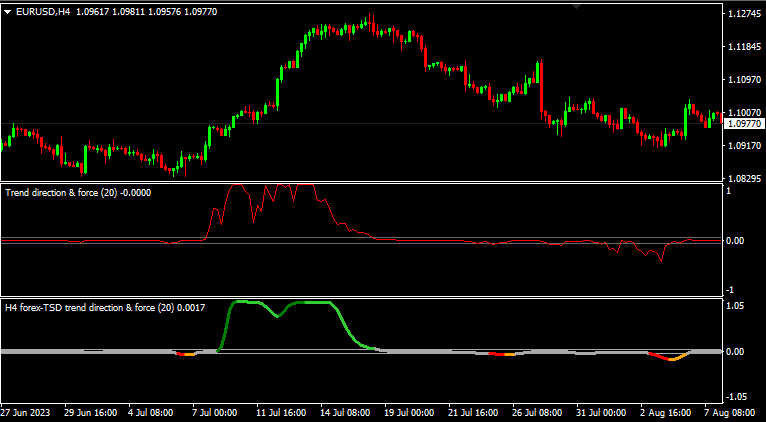

Another application for the Metronome is confirming that your indicator setup (mainly filter indicators) is correct. Setting the Metronome to produce one signal per candle and setting it to C1 you will easily see if your filter indicator is working as expected. In the image below you can see an example.